A great deal of ink is spilled every year debating the difficulty of planning for retirement. There’s so many factors involved that it’s very easy to lose track of one or other of the variables – longevity, investment returns, risk exposure, taxation, spending patterns etc. And of course, the variables keep changing. I suppose that’s the thing with variables.

To make matters yet more complex, there’s a highly subjective factor affecting your experience of life after work: the likelihood of poor health.

What are the odds that your health breaks down in retirement? And what would the impact be on your spending? And it’s worth remembering that your own health outcome is largely independent of your partner’s. But this means the risk impact from poor health on the couple is greater than for just one individual. Neither of you can go on a cruise if one of you is sick.

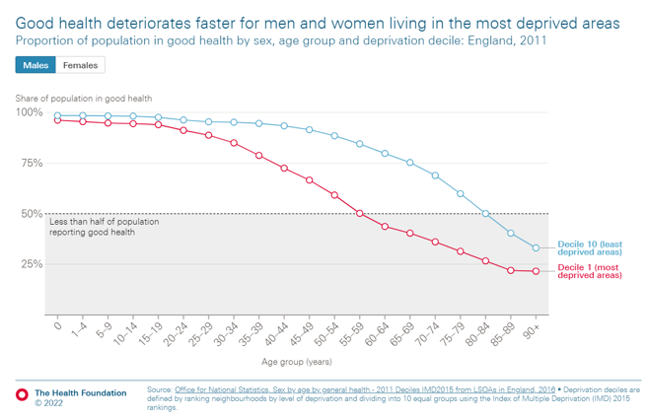

Research by the Health Foundation based on ONS data clearly shows the striking relationship between wealth and ill health in the UK.

This data shows that individuals in a more affluent couple – those likely to work with an adviser - stand a 50% chance of being in good health in their mid-80s. It follows that for the couple taken as one unit, 50% of couples would find one party in poor health, and in 25% of couples both partners would be in ill health.

The key variables

To answer the central retirement planning question: “Will I have enough money?”, we go back time and again to considering life expectancy and sequence risk.

Using the 2020 life tables, I calculate that the odds of both parties in a male/female couple, aged 65, living to 85 are around 25%. The odds of both spouses passing away by that age are similar, meaning that half of all couples are separated by a bereavement before the survivor reaches their mid-80s.

What about sequence risk? What are the chances of a bear market in the first few years of retirement? My suggestion is that this is about a 1 in 4 risk, on the basis that there have been, say, 15 bear markets since 1945.

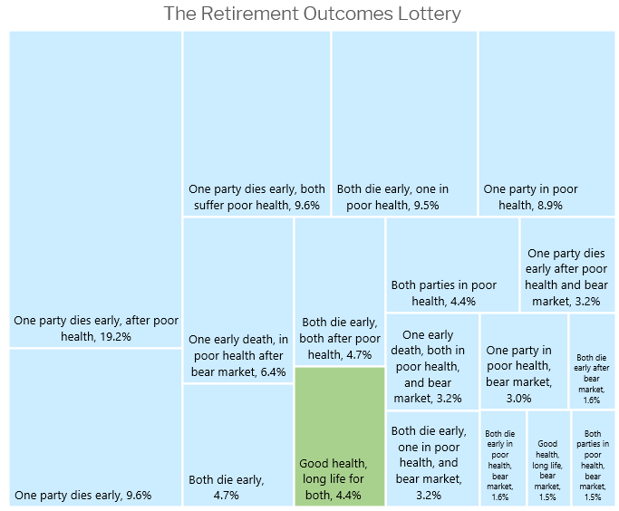

Here’s a diagram of the retirement outcomes lottery. It leaves out all the other factors, but combines these three key variables: death, poor health and an early bear.

I wouldn't thank my financial adviser for sharing this outlook on the future with me, or my wife, without careful preparation. Instead, I'd much rather cling to my confident expectation that we'll both live out a long, active, comfortable retirement enjoying an easy ride in markets. Life, it seems, may have other plans.

But these odds do confirm for me the importance of planning to enjoy the early years away from work. The odds of finding the secret of eternal youth, on the other hand, seem to get lower with every passing year.

Find out more about Parmenion's approach to drawdown focused retirement investing.

Patrick Ingram will be debating the main challenges advisers face when giving advice on retirement income with a range of independent experts and thought leaders in a new 3 part Let’s Talk Retirement webinar series. Book your place here.

This article is for financial professionals only. Any information contained within is of a general nature and should not be construed as a form of personal recommendation or financial advice. Nor is the information to be considered an offer or solicitation to deal in any financial instrument or to engage in any investment service or activity.

Parmenion accepts no duty of care or liability for loss arising from any person acting, or refraining from acting, as a result of any information contained within this article. All investment carries risk. The value of investments, and the income from them, can go down as well as up and investors may get back less than they put in. Past performance is not a reliable indicator of future returns.