After a slow start in January, investors with diversified portfolios are now experiencing positive returns for the year so far.

It’s a reassuring development and the current outlook is optimistic – there are growing expectations of a 'soft landing', characterised by slower growth without a significant rise in unemployment. These factors have buoyed investor confidence and prompted improvements in GDP growth projections.

However, we’ve also seen an increasing dispersion of returns – which brings both risks and opportunities for investors.

Record highs and lows

US, Japanese, and German equities have surged to record highs. In the US, solid economic growth and earnings from sectors like consumer discretionary and consumer services, (together with holding four of the “Magnificent 7” mega-cap stocks) have played a crucial role in driving returns.

Meanwhile, Japan has seen a resurgence driven by executive boards prioritising shareholder value and corporate restructuring alongside stable inflation and a favourable currency landscape.

Despite Germany's recession and challenges in the manufacturing sector, there are reasons for optimism as markets anticipate monetary policy easing by the ECB.

A closer look at the US

The S&P 500 has shown impressive returns of over 16% since the low in late October 2023. However, this growth has been overwhelmingly driven by just a handful of major companies, called the Magnificent 7 - made up of Nvidia, Meta (Facebook), Microsoft, Amazon, Apple, Google, and Tesla.

Looking more closely, we can see that only a subset of these companies have actually led the gains YTD, as Apple, Google, and Tesla have fallen short of expectations and consequently seen their share prices weaken.

Risks and opportunities

This situation presents risks and opportunities for investors. Relying heavily on a few companies for index returns, given elevated earnings forecasts and rich valuations, could be a cause of worry for passive investors globally. However, if a ‘soft landing' is achieved, smaller companies may benefit, offering active managers a chance to outperform.

Conversely, Chinese and UK stocks remain unpopular and have been labelled as 'un-investible' or 'irrelevant' respectively. While we don't agree, we acknowledge that both countries need clear policies to boost investor confidence, drive productivity, competitiveness and therefore earnings. There are early signs of improvement in both countries, which suggests a potential for better returns, despite the current low expectations.

Central banks - different challenges, different policies

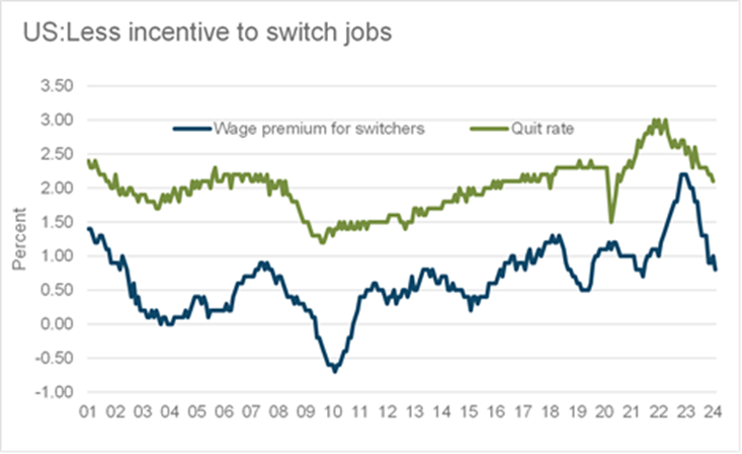

Through the interest rate hiking cycle of 2022 and 2023, central banks were synchronised in their fight against inflation. Now however, inflationary pressures and economic growth outlooks appear to be diverging. US disinflation is progressing, though it's happening more slowly than previously anticipated, mainly because of high prices for housing and service sectors. But with a cooling labour market, the quits rate falling to pre-COVID levels and salary increases dwindling for job switchers, the possibility for Federal Reserve easing from its current restrictive stance remains.

Source: Oxford Economics

A more complicated picture for the ECB and BoE

For the European Central Bank (ECB), record-low unemployment poses a risk of upward pressure on wages, but economic growth is already lacklustre with an uninspiring outlook. Monetary easing looks necessary but the ECB’s cautious, data dependant approach could risk a longer and deeper economic downturn.

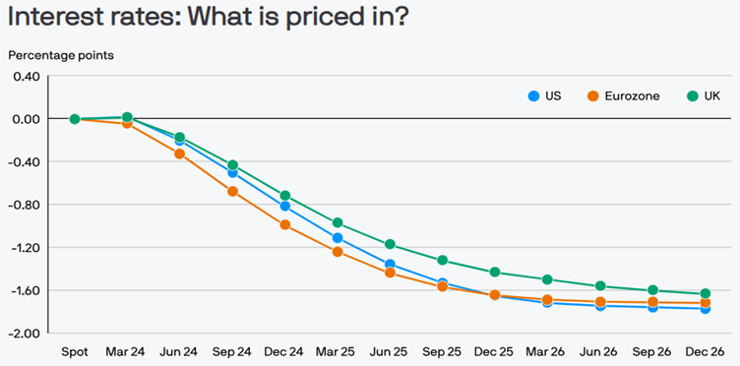

The Bank of England (BoE) faces a similar dilemma and is in a tough spot. Inflation is predicted to settle around the 2% target by early summer, allowing for possible monetary easing. But with wages growing at 5.6%, there's a worry this could reignite inflation. As a result, there's a chance the BoE might delay and move more slowly, something the market seems to have already priced in as you can see in the chart below.

Source: J.P. Morgan Asset Management

Selective diversification

While the chances of a recession have decreased, historical US data since the 1950s suggests that it typically takes about 23 months from the first interest rate hike for a recession to begin. With the Fed's initial hike occurring in March 2022, we're still in a risky period, now at 24 months. Therefore, caution, discipline, and diversification remains crucial, particularly in assets that have performed well.

Looking ahead to 2025 however, we're growing more optimistic about growth prospects. Given current valuations, being selective will be increasingly vital for long-term returns, as stock prices start relying more on fundamentals rather than broader economic trends. Expect volatility, especially in this election-heavy year, so patience and commitment will be key.

This article is for financial professionals only. Any information contained within is of a general nature and should not be construed as a form of personal recommendation or financial advice. Nor is the information to be considered an offer or solicitation to deal in any financial instrument or to engage in any investment service or activity.

Parmenion accepts no duty of care or liability for loss arising from any person acting, or refraining from acting, as a result of any information contained within this article. All investment carries risk. The value of investments, and the income from them, can go down as well as up and investors may get back less than they put in. Past performance is not a reliable indicator of future returns.