2023 reminded investors of the long-standing investment principles that guide the pursuit of attractive risk adjusted returns: diversification, patience, a long term investment horizon and calm in the face of adversity. But last year added another valuable reminder too – the need to be wary of consensus thinking.

At the start of 2023, expectations of recession in developed markets were widespread. Having come through the fastest rate hiking cycle in 40 years, it was reasonable to expect an economic fallout that would weigh on corporate earnings and depress equity valuations. However, with expectations so low and cautious positioning so prevalent, it actually became easier for macro data to surprise on the upside.

The same held true for fixed interest over the summer and early autumn. Central bankers’ recurring message that rates would remain higher for longer led to increased short positions in medium to long duration government bonds. With the release of lower-than-expected inflation in October and November, we saw a wave of short covering and the unravelling of these crowded positions.

The trend is your friend - until it's not

Going against consensus is never easy and may feel uncomfortable. However, if underpinned by compelling valuations and applied within a diversified and disciplined structure, it can be rewarding over the long term. Our Asset Allocation Committee recently reviewed our current positioning, and identified a few anti consensus stances that we are quietly confident about.

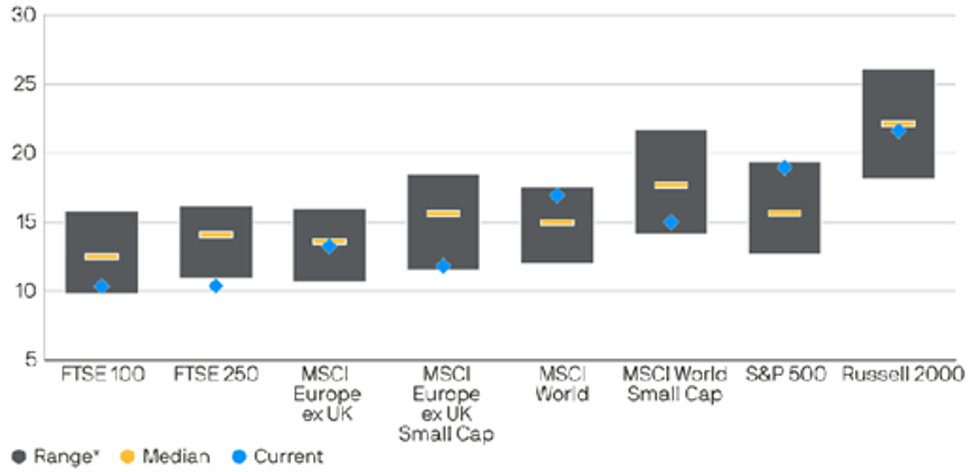

First is small caps. Having come through a torrid period of underperformance, investor exposure is light, valuations are at or near to record lows, and expectations depressed. Even if there is a mild recession, which we’re not ruling out, small caps already appear priced for this. That means if a soft landing is achieved, there is scope for considerable upside surprise. Furthermore, history suggests that small caps outperform following the peak in interest rates, as investors look forward to a pick up in activity as interest rates decline.

Small Cap Forward P/E Ratios (x, multiple)

Source: J.P. Morgan Asset Management

UK equities is another deeply unloved, under-owned and cheap asset class (arguably, this has been the case for a while). We’re confident the value on offer will be realised this time thanks to the prospects of:

- an improvement in domestic growth as real incomes turn positive

- the declining cost of living for households as inflation normalises and mortgage rates moderate

- solid recurring cashflows underpinning attractive earnings yield

- an easing of or end to selling pressure following 31 consecutive months of investor outflows

With UK institutional pension fund UK weightings now down to around 5-6% on average from approximately 40% in the 1990s, we might wonder who is left to sell?

Lastly, having underperformed for 3 consecutive years, Emerging Markets are cheap and a consensus underweight. GDP growth forecasts of 4-4.5% for 2024 and 2025 look achievable as stimulative monetary and fiscal policies are rolled out, with inflation already close to/below central bank targets. Furthermore, the relative stability in EM currencies during a period of material Fed tightening shows just how far EM macro has changed from the past. We believe the risk reward trade off for EM has notably shifted in their favour.

Selectively opportunistic

Despite the euphoria in markets in the last quarter of 2023, we know there can be long and variable lags before the full impact of monetary tightening in this cycle takes effect. As a result, we retain a cautious tilt within our portfolios. Lessons learned from 2023’s concentrated consensus positioning, along with our continued commitment to a disciplined investment process of seeking long term opportunities have helped us identify some selective opportunities that we believe will deliver compelling returns for investors over time. Hopefully 2024 will be the year in which they start to show their worth.

This article is for financial professionals only. Any information contained within is of a general nature and should not be construed as a form of personal recommendation or financial advice. Nor is the information to be considered an offer or solicitation to deal in any financial instrument or to engage in any investment service or activity.

Parmenion accepts no duty of care or liability for loss arising from any person acting, or refraining from acting, as a result of any information contained within this article. All investment carries risk. The value of investments, and the income from them, can go down as well as up and investors may get back less than they put in. Past performance is not a reliable indicator of future returns.