Accelerated monetary tightening by central banks aiming to curb inflation is beginning to take effect. Second quarter US GDP contracted 0.2% quarter on quarter, compared to a 0.4% quarter on quarter fall in Q1. Disposable income has been squeezed by a higher cost of living, with food, fuel and energy prices rising substantially. Combined with higher mortgage rates and debt servicing costs, this is taking an increasing toll on the consumer. As a result, belt tightening is underway and measures of excess demand are becoming less positive.

This will likely lead to broader weakness in macroeconomic data, including a cooling in the labour market, something that the Federal Reserve has been aiming for. With the US unemployment rate at 3.6% the Fed’s ‘full employment statutory objective’ looks to have been met, leaving them to focus on inflation. However, employment data is known to be a lagging indicator. With the economy slowing, corporates are already announcing hiring freezes, with many even reporting job layoffs. The roll back of state benefits and cost of living pressures are forcing people back to work, which could undermine the perceived ‘tightness’ in the labour market.

The Fed insisted the US is not currently in recession following its recent policy meeting at the end of July. However, if history is anything to go by, an increase in the unemployment rate of just 0.3% tends to coincide with a recession, so it’s probable a recession will be confirmed imminently.

This means the aggressive path of central bank monetary tightening may continue for another few months, but could be nearing a peak. Bond markets have priced in further interest rate rises, so there’s potential for interest rates to peak sooner and at a lower level.

Anticipation that the recent tightening of financial conditions, which acted as a depressant on market valuations, could ease is cause for optimism. Positive sequential returns can be built on from here.

GS Financial Conditions Index

Source: Goldman Sachs and Bloomberg.

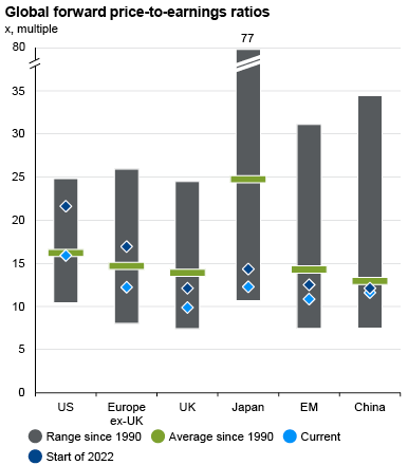

Following the sell-off across equity and bond markets year-to-date, valuations are now notably more attractive for long term investors (see below).

Source: IBES, MSCI, Refinitiv Datastream, J.P. Morgan Asset Management

Yes, further volatility is to be expected as negative macroeconomic headlines influence investor sentiment.

However, for investors with a diversified portfolio, the bad economic news today looks increasingly likely to be good financial news for tomorrow. Stay disciplined and committed to your financial plan and allow compounding the opportunity to deliver.

This article is for financial professionals only. Any information contained within is of a general nature and should not be construed as a form of personal recommendation or financial advice. Nor is the information to be considered an offer or solicitation to deal in any financial instrument or to engage in any investment service or activity.

Parmenion accepts no duty of care or liability for loss arising from any person acting, or refraining from acting, as a result of any information contained within this article. All investment carries risk. The value of investments, and the income from them, can go down as well as up and investors may get back less than they put in. Past performance is not a reliable indicator of future returns.